Substantive Taxation Principle and the Improvement on Chinese Taxation System

author:Shi Zhengwen 丨source:Journal of IFA, Korea, Vol.30-2(2014) 丨time:2017-12-11Abstract: That a foreign investor of a non-resident enterprise transfers the equity of a resident corporate indirectly through transferring of shares of an intermediate holding company is a common technique being used in cross-border capital flow. According to the Corporate Income Tax Law of China, the place where the company is invested decides the origin of equity transfer and who has the right to levy tax, which also gives rise to the problem of legitimacy of tax right. The State Administration of Tax issued relevant documents to establish the substantive tax principles, adopted “piercing veil” to negate the existence of intermediate holding company and accordingly claimed the jurisdiction of taxation in order to deal with the growing tax base erosion andprofit-shifting. During the execution of tax right on indirect transfer, the transfer which has reasonable commercial purpose or meets the special terms of taxation treaty shall be free from taxation. China should prefect rules through legislation, clarify the circumstances about “reasonable commercial purpose” , to state clearly that there will be no tax liability on cross-border internal reorganization involving indirect transfer, to introduce the advanced tax ruling system and to perfect the system of supervising and controlling tax source.

Key Words: non-resident enterprise, indirect equity transfer, substantive tax principles, interpretation of tax law.

1. The definition and characteristics of a Non-resident enterprises’ indirect equity transfer

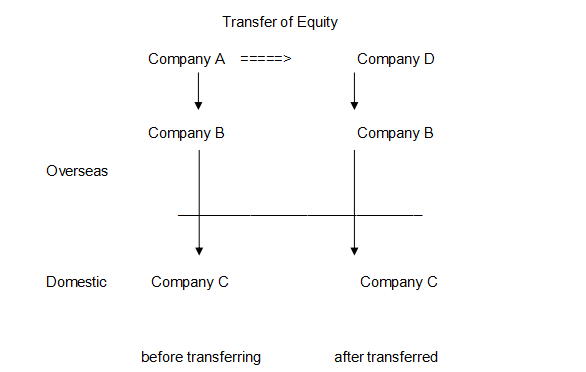

The non-resident enterprises’ indirect equity transfer of equity (“Indirect Transfer”) refers to the foreign investor (“Actual Controlling Party”) through the transfer of an intermediate holding company's equity to achieve the purpose of transferring the equity of a resident enterprise. In another words, the foreign investor establish a holding company (intermediate holding company) in overseas and the holding company directly or indirectly control Chinese domestic enterprise. Then if the foreign investor directly transfers the equity of domestic enterprise, the indirect transferring of equity of Chinese domestic company will happen. And the general tax arrangement is shown as below:

In the above chart, Company A is a non-resident company (“the Investor”), which holds the subsidiary Company B in overseas, and Company B holds a Chinese domestic subsidiary Company C. Company A transfers the equity of Company B to Company D (which can be set up either in overseas or in domestic).

The significant characteristic of an indirect transfer of a non-resident enterprise's equity is operated via an intermediate holding company, which could change the source of income derived from the equity transfer.[1]The intermediate holding company is often set up in those overseas tax havens, low tax countries or regions, where the resident enterprise could achieve tax avoidance purpose.

In practice, China has successfully collected income tax from more than 20 indirect equity transfer cases since 2008, which included the largest single tax revenue of more than RMB400 millions. However, tax right against non-resident enterprises for indirect equity transfer has been a controversial issue in the academia in China. The above subject involves the criteria issue for determination of the source of income, the application of the substantive taxation principle, the effectiveness of tax treaties and other issues. In order to understand and resolve these issues correctly, we need to apply the interpretation theory of law.

2. Determination of the source of income derived from a non-resident enterprise’s indirect equity transfer

Non-resident companies undertake limited tax liability in the source of income, which means the Chinese government could only tax a non-resident enterprise if the source of income is from China. Therefore, to identify the source of income is the key, which will justify China to exercise the right to tax against non-resident enterprises for indirect transferring of equity. According to Article 7 of the Implementation Regulations of China Enterprise Income Tax Law of the People’s Republic of China, the source of income derived from the transfer of invested equity assets is determined by the location of the invested enterprise. However, there is no distinguish between direct transfer and indirect transfer of equity in the Enterprise Income Tax Law of the People’s Republic of China and its implementing regulations. Therefore, there is one view in accordance with the literal interpretation that Chinese government can only tax a non-resident enterprise shareholder of a resident enterprise when they transfer their respective shares of that resident enterprise directly to other investor(s). In the process of a non-resident enterprise indirect equity transfer, the shares that being transferred are the equity of the intermediate holding company offshore and are not the shares of a Chinese domestic enterprise, therefore, Chinese government does not enjoy the right to tax. However, there is another view, which is that the teleological interpretation shall be applied, and the scope of income derived from the transfer of invested assets in the above Law shall be extended, and those incomes derived from the indirect transfer of equity by a non-resident enterprise, which has a purpose of tax avoidance, shall be included therein. As from the above chart, if the country where Company B located did not tax Company A for the transfer of Company B's equity and, Chinese government also does not tax Company A for the indirect transfer of Company C's equity, which will result in a double non taxation issue from the countries of origins and that contradicts to the principle of equitable distribution of international tax benefits.Therefore if the country, which Company B locates in, tax the income derived from the equity transferring of non-resident enterprise, China must give up the right of taxation. Or it will give rise to the problem of double taxation. And because of the above reason, the State Administration of Taxation has issued a new document named The Notice of Strengthening the Management of Enterprise’s Income Tax on Income Derived from Non-resident Enterprises by Transferring of Equity (State Tax Bureau No.[2009] 698) “. And its Article 5 stipulates the preconditions of taxing the income of indirect transferring equity, that is “during the process of indirect equity transfer of Chinese resident enterprise, if the actual tax burden of the country (district), which the foreign holding company set up in, is below 12.5%, or the country doesn’t tax the offshore income.”

But there may be a question remained if we use the above second view as the basis for exercise the right to tax. As the tax law, being a kind of infringement norms, should strictly follow the principle of legality in order to protect the taxpayers expectation of tax stability.[2] Therefore, we should be particularly careful when applying the teleological interpretation. If we simply conclude in general that the source of income derived from transfer of equity is where the invested enterprise located, then there could be a loophole existed when regulating the income tax for indirect transfer of equity by non-resident enterprises. In order to satisfy the purposes and achieve the functions of tax law, the Enterprise Income Tax Law of the People’s Republic of China stipulates the substantive taxation principle of the general anti-avoidance provisions.

3. Substantive taxation principle and the right for income derived from the indirect transferring of equity by a non-resident enterprise

Tax law concerns the economic ability to pay of taxpayers, and the principle of assessment is required either for the confirmation of tax liability or for the interpretation of tax law. Therefore, special attention should be paid on economic substance. In other words, when interpreting the tax laws and confirming the facts of tax liability, we should base on the economic substance of transactions rather than on its external legal forms in order to achieve a fairness of taxation. For example, according to the Article 42 of the German Tax Law Principle: "Tax cannot be voided due to the possibility of abuse of the law derived from circumvent its application. When an abuse is occurred, tax right can be applied in accordance with the legal form of considerable economic events. According to the Paragraph 1 of the Article 12 of the China Taiwan Tax Collection Law : "for matters involving tax law, which should be interpreted in the spirit of the doctrine of the tax law, in accordance with the legislative intent of the law and in consideration of the economic significance of the principle of fair taxation.", in Paragraph 2:"when the fact of a tax liability shall be confirmed, the tax authority should base on the fact of a real economic relationship and the real economic benefits vested and entitlement." Therefore, the substantive taxation principle is also a teleological interpretation, which is a method used to interpret tax law based on the purpose of tax law norms.

One of the important features in the implementation of the new the Enterprise Income Tax Law of the People’s Republic of China in 2008 was established the general anti-avoidance rule, which represents the essence of the substantive taxation principle. According to the Article 47 therein: "the tax authorities are entitled to make a reasonable tax adjustment to an enterprise, which tries to reduce their taxable income or gains by implementing any non-reasonable commercial arrangement. The Article 120 of the Implementing Regulation of the Enterprise Income Tax Law of the People’s Republic of China stipulates that "a non-reasonable commercial arrangement means any arrangement for reducing, avoiding or postponing paying taxes as the main purpose. " In order to restrain the frequent incidents of tax avoidance by non-resident enterprises regarding equity transfer,the China State Administration of Taxation issued the notice on the strengthening of the Enterprise Income Tax Management Regarding Income Derived from Non-resident Enterprises’ Equity Transfer issued by the China State Administration of Taxation (State Tax Document 2009/698) states: "When a foreign investor (“Actual Controlling Party”) through the abuse of forming any organizations to indirectly transfer a Chinese resident enterprise's equity, does not have a reasonable commercial purpose, and is for the purpose of avoiding enterprise income tax liability, then the concerned tax authority should report it to the State Administration of Taxation and once authorisation is obtained, it can re-characterize the equity transfer in accordance with the economic substance and, to deny the existence of the offshore holding company. By following this rule, for the act of an indirect transfer, if the foreign enterprise being transferred is a shell company, the tax authority could deny the existence of that company by adopting the principle of "pierce the veil", and determine that the foreign investor is in fact transferring the equity of a Chinese resident enterprise..But we should treat the nature and purpose of transferring integrally and historically, and the existing of holding company shall not be negated only because that the intermediate company doesn’t have any real business. Usually, the purposes of offshore investments such as Special Purpose Vehicle (SPV) setting up in the place where the favourable policies for the avoidance of tax or investment can be provided, are avoiding repeated taxation through the investment structure with more tax efficiency, maximizing the benefits of investment through reasonable tax planning, or prior scheming withdrawal of capital. And all the above purposes are reasonable in business. In the case against Vodafone in India, the Judge considered that whether the purpose of a intermediate company is avoiding taxation or whether a intermediate company has reasonable business purpose, should be decided in the consideration of the following matters: the lasting time of a intermediate share-holding structure, the enterprise’s operating time in India, the Indian taxable income derived from the enterprise, the time of the foreign investor withdrawing capital and the lasting state of business after the foreign investor’s withdrawal. Intermediate holding company is a vital international investment tool, especially when an intermediate holding company had been set up before domestic investment, we cannot simply conclude that the purpose to establish the intermediate company is just for withdrawing capital and avoiding taxation. And the legal form of such kind of company should be respected.[3]

The application of “Piecing method” in China and the “perspective method” stipulated in the treaty of anti-abusing taxation promulgated by OECD can learn from each other. The treaty of anti-abusing taxation is used for preventing the resident in non-contracting states achieve improper tax favourite through the conduit company which established in the contracting countries of tax convention. There are mutual similarities between abusing tax convention and indirect equity transfer: (i) involving intermediate entities and indirect operating; (ii) through indirect transaction without economic nature. One of the important methods of Anti-Abusing Taxation Treaty is “perspective method” which refers that whether a resident company may enjoy preferentienl treatment according to taxation agreement depends on whether the final beneficiary of the company is the resident of contracting states. And if a resident company setting up in one contracting state is not finally controlled by the resident of either contracting states, it cannot enjoy preferentien treatment. If a non-resident enterprise indirectly transferrs the equity of Chinese resident company, China shall not have the right of taxation only according to the jurisdiction of territorial principle or personal principle, but the adoption of “piecing method” provides the legal basis for China to execute the right of taxation, for the main point of “piecing method” is to review the latent transaction behavior to penetrate superficial related transaction and trace the beneficiary,so that we has the right to tax the income derived from equity transfer..[4]

The adoption of “piecing method” in anti-taxation is learned from the system of legal person’s qualification negation in the Company Law. The principle to find out the taxation responsibility of the shareholders in legal persons who set up companies for avoidance of taxation has been adopted by many states. It is not to negate the personality of legal person, but to adopt the principles of substantive tax and put the obligation of tax payment into substantive tax payment. We need to point out that the reasons why the India tax authority loss in a court case against Vodafone, which had indirectly transferred equity were that income derived from indirect transferring of equity had not been considered as domestic income by the India tax law at that time and, they did not have general anti-avoidance rules neither. As the statement in the judgement of Indian Supreme Court, unless the stipulations of law have been changed, no one shall interpret them beyond the original meaning or extend the extensions. Thus, India have modified the tax law, and stipulated that if all the values of shares or benefits of a company derive from assets within Indian territory directly, indirectly or virtually, even though this company is located outside India, the values of shares or benefits should be regarded as within Indian territory. Besides, the modified tax law has included the stipulations of anti-avoidance taxation.[5]

The above provisions of the Enterprise Income Tax Law of the People’s Republic of China have their significances when facing the serious situation of tax avoidance by transferring the cross-border tax sources to tax havens in order to avoid the tax jurisdiction exercised by the resident country. The above provisions also echo the action plan in dealing with the tax base erosion and profit-tranferring by the OECD.

4. The applicable restrictions on Substantive taxation principle - the exceptions for the taxation of indirect equity transfer by a non-resident

In order to follow the principle of legality of the legal interpretation, the substantive taxation principle should be subject to necessary restrictions. Otherwise, it may cause harm to the statutory of taxation, the economic activities will unlikely to be predictable and the stability of the tax law is also out of the question. The following two situations are included in the tax exceptions for indirect equity transfer by non-resident enterprises:

4.1. The exception of reasonable business purpose

Common law countries developed “business purpose doctrine” through judicial precedent. A typical example is the Ramsay doctrine by the House of Lords in IRC v.Ramsay and IRC v. Burmah Oil Co. Ltd,. In the case, the taxpayer gained a considerable amount of capital income, by a series of complex transactions which lack of substantial economic consequence an loss was artificially created and the taxation on the capital income should be due was avoided. The House of Lords decides that the former arranged steps of transaction shall be deemed as one transaction and judge the effects of taxation as whole, if the arranged steps has no commercial purpose except avoiding taxation. Therefore the nature of Ramsay doctrine is as followings: first, the court could interpret the tax law according to the purpose of legislation rather than the literary content of articles; Second, no matter how complex or truly the plan of tax avoidance is, if the consequence of the plan has no reasonable commercial purpose except tax avoidance, it shall be null and void.[6] The civil law countries usually adopt the forms of articles on general anti-avoidance taxation in order to conclude and abstract the descriptions of reasonable commercial purpose. And the reasonable inference and judgement of such purpose need to be decided by law enforcement authority.

In that way, whether, when it happened that a transaction with business purpose has the consequence of ”reduce, exempt or defer of taxation”, non business purpose can be concluded? The question is related to the boundary line of GAAR. Back to Ramsay, the taxpayer purchased a tax planning scheme from a promoter, “The general nature of this was to create out of a neutral situation two assets one of which would decrease in value for the benefit of the other. The decreasing asset would be sold, so as to create the desired loss; the increasing asset would be sold, yielding a gain which it was hoped would be exempt from tax.At the end of the series of operations, the taxpayer’s financial position is precisely as it was at the beginning, except that he has paid a fee and certain expenses to the promoter of the schemes. There are other significant features which are normally found in schemes of this character. First, it is the clear and stated intention that once started each scheme shall proceed through the various steps to the end….Secondly, although sums of money, sometimes considerable, are supposed to be involved in individual transactions, the taxpayer does not have to put his hand in his pocket….The money is provided by means of a loan from a finance house which is firmly secured by a charge on any asset the taxpayer may appear to have, and which is automatically repaid at the end of the operation….Finally, in each of the present cases it is candidly, if inevitably, admitted that the whole and only purpose of each scheme was the avoidance of tax.”[7] It is obvious that, Ramsay doctrine weighs more on the business value of the transaction, however, its following cases draw some limitations to it. ”Ramsay doctrine does not permit to deprive the legal or fiscal effect of a licit transaction only base on the tax benefit”. Thus, non business purpose cannot be found only on the consequence of reduction or deferral of taxation, unless after certain tests it can be decided that, the arrangements were intended for tax avoidance from the exact beginning, and there is no other reasonable business purpose realized after the transaction.

According to the stipulations of Chinese tax law, when applying the general anti-avoidance rule to indirect transfer of equity by a non-resident enterprise, the indirect equity transfer of the taxpayer must be seen as having a "no specific reasonable commercial purpose". As you see, when dealing with the anti-avoidance rule, China also consider the commercial value of the transaction in order not to depriving the commercial value of the tax saving benefits. That is, not to tax an indirect equity transfer when there is a sounded commercial arrangement. According to the interpretation of the Article 120 of the Implementing Regulation of the Enterprise Income Tax Law of the People’s Republic of China, firstly, the main purpose of having an indirect transfer is for tax avoidance rather than forming any reasonable commercial arrangement. Secondly, there is a consequence of reducing, avoiding or postponing paying tax. The Article 92 of the Chinese Implementation Measures for Special Tax Adjustments (Trial) stipulates that the following 5 situations are classified as non-reasonable commercial arrangements:

a. the abuse of tax incentives

b. the abuse of tax agreement

c. the abuse of company formation

d. tax avoidance by using a tax haven

e. other situations

4.2. Specified exceptions in tax agreements

Income derived from equity transfer is a kind of "capital gains" in tax treaty. According to the OECD model, the tax right is exclusively fallen onto the resident country where the transferor located. And when the model was modified in 2003, the following rules was added in the model: only if the share value of company being transferred directly or indirectly derived from the real estate in one contracting state is more than 50%, the contracting state where the transferee enterprise located shall enjoy the right of taxation. The UN model, however, regulates such kind of capital gain according the two different circumstances as follows: i. If the assets of a company are mainly constituted by immovable property in contracting state directly or indirectly, the contracting state where the immovable property is located in may execute tax right on the income derived from the transferring equity of the company. ii. If the equity being transferred is beyond specific portion, the contracting state which the transferee company situated in may be entitled to tax. The rules for coordination regarding the taxation on capital gains provided by the UN have been adopted by many countries. On the subject of taxation on capital gains, China is mostly in reference with the template governed by the United Nation when signing tax treaties with foreign countries, especially refers to the Avoidance of double taxation and the prevention of fiscal evasion agreement between China and Singapore, which represents the future trend for taxation agreement to be signed stipulates that there are only 2 situations that the country of origin has the right to tax the equity transfer: a. If the main assets of a company are directly or indirectly belong to the fixed assets of the other contracted company situated in the contracting country, then that contracted country has the right to tax the benefits generated by the equity transfer of that company; b. If the equity being transferred is equal to 25% shares of the resident enterprise signing the contract, the benefits generated by transferring of equity from a company can be taxed by the contracted country. Therefore, if the foreign investor (a resident enterprise of a country, which has a concluded tax treaty signed with China) has indirectly transferred less than 25% of a Chinese resident enterprise (company mainly has fixed assets) and, the above regulations have been concluded in the tax treaty made by both China and the non-resident country, then the taxing right of China, being the source country will be limited so there will be no tax to that foreign investor.

Furthermore, even the indirect transferring may be taxed by taxation convention, the source country shall only execute limited right of taxation, which refers to the source country shall tax the foreign investor’s indirect transferring in accordance with the rules of negative income of non-resident enterprise and obey the tax rate stipulated by taxation convention.

5. Perfecting the taxation system on indirect transferring of equity between non-residents

Overall, when China applies the substantive principles of taxation to regulate the tax avoidance behavioursof non-resident enterprises through the indirect transferring of equity, the regulations and policies are relativelysimple and lack of legal clarity and operability such as lacking guidelines for the defining un-reasonable commercial purpose, failing to stipulate special taxation deals regarding the indirect action of transfer involved in the internal restructuring, lacking the stipulations for the calculation of income and weak in monitoring the sources of tax, etc. Under the open economy condition, the cross-border transfer of property including the cross-border reorganization is the vital constitution of free capital flows. The policy of tax should be keep neuter and shall not impact the ordinary transfer of property of multinational company. If the principle of tax neutrality has been abided by, the negative impact on the taxing cross-border transferring property shall not happen. And the key of abiding the principle is to enhance the clarification of taxation of indirect transfer[8]. Various countries hope that the application of general rules of anti-avoidance taxation would provides the clarification standards for the applications of law. But owing to the generality of its rules, the applications of above general rules aggravate the un-clarification of taxation. And this problem should be settled during the improvement on non-resident indirect equity transferring.

5.1. To improve the terms and regulations at a higher level of legal mean

Substantive principles of taxation are powerful weapons to prevent and combat tax evasion. However, In order to improve the legitimacy of the regulation and its legal effect, legislation must be passed for governing the applicable situations, legal requirements and operating procedures specifically. For examples, China has no respective provision for levying personal income tax when a non-resident individual investor indirectly transfers equity. It is unknown that whether the general anti-avoidance principle can be applied. They should be included in the future. The existing detailed rulings for taxing corporate investors are based on the administrative provisions interpreted by the State Administration of Taxation, they shall be risen to the legal level.

5.2. Clearly define the specific circumstances for having "legitimate commercial arrangements"

The most important policy on indirect transfer is the notice on the strengthening of the Corporate Income Tax Management regarding income derived from non-resident enterprises by transferring of equity (State Tax Document 2009/698),but it fails to summarize or list the situations about reasonable commercial purpose. Therefore it should be complied with the listed situations in Implementation Measures for Special Tax Adjustments (Trial). The State Tax Document 2009/698 stipulates the obligations of submitting documents for non-resident investor, which refers to such obligation should be performed by the foreign investor (actual controller), the actual tax burden of which is lower than 12.5% or free from offshore income tax. In other words, the target enterprise which dose not establish in the tax heaven is free from the obligations of submitting documents. The State Tax Administration has issued a notice On Simplifying the Judgement of the Actual Tax Burden of the Country where the Foreign Company Controlled by Residents of China Established in (State Tax Document 2009/37). In this document the white list includes 12 countries, such as USA, UK, France, Germany, Japan, Italy, Canada, Australia, India, South Africa, New Zealand and Norway. For the above-said document is only the supplementary of the stipulations of “foreign holding company”, it should be clarify that whether the obligations of submitting documents shall be released, if the offshore investor can prove such target company has been established in the above-said countries.

Therefore defining the meaning of reasonable commercial arrangements should provide both positive and negative examples to enumerate the specific circumstances, For examples, the positive examples on situations where there is no legitimate commercial arrangement would include: the abuse of company formation, the abuse of tax incentives; the abuse of tax agreements, etc. Negative examples on situations where there are legitimate commercial arrangements would include: the trading objective for both contracting parties is to listing a company in overseas; the trading objective has been existed for relatively long time and is not being set up for this particular transaction; the Chinese domestic assets ratio in the trading objective is under the minimum limit within its consolidated financial statements, etc.

5.3. Clearly define the legal requirements for taxation

The following legal requirements needed to be proven when indirect transferring of equity is confirmed to be taxed: 1). The offshore intermediate holding company does not have any economic substance, the business being directly transferred is a shell company registered only in the host country, it does not engage in any substantive business activities. More specifically, such offshore enterprise usually has little or even no employee; its assets only include the investments to the Chinese resident enterprise; its income mainly derived from the distribution of dividends and only pay little income tax or even dose not pay income tax in its registered country. 2). Does not result in double taxation by the country of origin, which means the foreign country where the intermediate holding company is located does not tax the income derived from equity transfer by its resident enterprise; 3). From the value of the transaction to deny the existence of the offshore intermediate holding company because the equity transfer price is depended primarily on the valuation of the Chinese resident enterprise's equity; 4). Both parties involved in the equity transfer committed that the actual objective of the transaction is for the best interests of the Chinese resident enterprise.

5.4. State clearly that there will be no tax liability on cross-border internal reorganization involving indirect transfer

China and most other countries are providing deferred tax incentives for enterprises. In accordance with the above State Tax Document 698, the income derived from non-resident enterprise equity transferring may be chosen to apply the deals of special taxation, if the transferring complies with the situations of special reorganization stipulated in the State Tax Document 2009/59. According to the notice issued by the Ministry of Finance and the State Tax Administration On the Solutions on the Problems of Income Tax from the Enterprise Reorganization, where non-resident indirect transferring equity applies the special taxation deals, except the general circumstances, the following circumstances should be complied by: a. a non-resident enterprise transferring the equity of resident enterprise to another non-resident enterprise which 100% controlled by it; b. dose not change the burden of withholding income tax derived from the future transfer of such equity; c. the non-resident enterprise (transfer) shall give the written promise to concerned tax administration that do not transfer its owned equity of non-resident enterprise (transferee) in 3 years. To the above 3 circumstances, there are following 3 problems: firstly, the purchaser must be the 100% direct controlling non-resident, but , according to the investigation in several years, the both party of such transferring could seldom comply with such controlling relationship. Secondly, about the unchanged withholding income tax, in general, such circumstance should at least includes the unchanged burden of withholding income tax derived from the equity transferring income, but whether it should include the unchanged withholding income tax derived from the dividends, which the domestic enterprise distributes to the offshore shareholders, is still in controversy. Nevertheless the withholding burden shall not include the gains from equity investment in literal. Therefore the Document 698 provides the space for applying non-tax reorganization in non-resident indirect transferring equity, but the circumstances stipulated in the document could hardly be complied.

Since deferring tax incentives are provided for direct equity transferring in enterprise internal reorganization, same incentives should be applied in dealing with the taxation on indirect equity transferring in multinational companies’ internal restructuring. Therefore the future legislation shall stipulate that there is no tax liability on cross-border internal reorganization involving indirect transfer, if the below circumstances can be met: first, both the foreign transferor and the foreign transferee hold more than 80% stake of each other directly or indirectly, or 80% or more of the stake is held by the same party or the same parties, directly or indirectly; such portion should be in accordance with the same kind of stipulations in most of countries, for example, in USA, this portion is 80% and in UK and Spain, such portion is 75%. Or if the portion is too high, most of transfer could not meet its requirement. Second, it does not cause any subsequent corporate income tax loss when the equity transfer is done in the future. This policy is used to prevent the abusing taxation treaty by foreign corporation for whereas the equity transfer of internal enterprise restructuring is the resident of tax heaven which does not sign taxation treaty with our country, and the equity transferee is the resident of the country which have signed taxation treaty with our country, if the former transfer is free from taxation, the latter transferee may, according to the limits of 25% stake stipulated in taxation treaty (the foreign corporation shall not be taxed if the portion of stake of resident enterprise which hold by the foreign investor is less than 25%) avoid the obligation of tax payment in China.

5.5. To introduce tax advance ruling system

Tax advance ruling refers to the tax administration review the determined facts and applied laws (especially, the controversial legal problem) on the future or unfinished transfer, and issue the written verdict to the tax payer for the purpose of promoting the tax payment and the abidance of tax law. Unless the tax payer, during the process of applying advance tax ruling, make wrong statement or omit the documents regarding the facts of predict transfer or actual transfer, the tax payer may declare tax in accordance with the advance tax ruling. And the tax official shall abide by the advance tax ruling system when they evaluate and inspect the tax payment. Now 28 states in the all 30 member states of OECD have established the system of tax advance ruling and China is working hard to research and introduce such system too.[9] In view of there are many tax administration uncertainties existed in dealing with the non-resident enterprise indirect equity transfer, we could consider to introduce advanced tax ruling system, which allows the transferor to apply for an advanced ruling to determine whether there is any tax liability incurred. And it would improve the operating arrangements for tax certainty and to reduce a high cost for the post check and to response.

5.6. Perfect the system of supervising and controlling tax source

First, establish the system of submitting documents by foreign transferor. When the indirect transfer occurred, the foreign transferor should, if such transfer complies with the situations of paying tax, submit documents to the local tax administration of the resident enterprise, the equity of which has been indirectly transferred. Second, establish the system of cooperation of equity transferee. The equity transferring price charged by the transferor will be the cost of the transferee’s next transfer. Therefore, if the transferor fails to pay the tax which should be paid, the transferee shall not take the payment for equity transferring as the cost in its next transfer. It means that the transferee will be required to positively cooperate with tax administration on submitting documents or even acting as the withholding agent. Third, build the system of resident enterprise assisting. The resident enterprise shall not only provide the information about transfer, but also shall provide the structure of shareholders which could illustrate the information about controlling party and other shareholders in different levies ,in order to help the tax administration supervise the indirect transferring in time. Fourth, build the system of collecting and sharing information for tax administration. The government information exchange system should be established. And the departments such as commerce, industry and commerce, exchange control, securities regulatory, and media as, paper, internet shall provide information to tax administration.

In conclusion

Taxing on non-resident enterprise indirect equity transferring is a hot and controversial problem in the area of international taxation. As other countries, China generally regulates such problem by applying the terms of anti-avoidance taxation in substantive tax principle. In legal hermeneutics, the principles of legality and substantive principles of taxation are the most important elements in explaining Taxation. But, there are inherent conflicts and tensions between the two. Nevertheless, under the basic spirit of the statutory of Taxation, we should try to achieve a balance of interests between both parties, so that it is not only safeguarding the free operations under the subjects of private law and property rights, it also emphasizes the fairness of taxation and public interest. Therefore the matters regarding substantive tax principles such as scope of application, legal requirements, operation process, supervision and protection should be defined clearly de jure. Especially, the connotation and scope of the principle of reasonable commercial purpose should be clearly defined and introduce advance tax ruling system in order to enhance the clarification of taxation regarding indirect transfer. We should obey and perform the international obligations stipulated by taxation treaty and maintain the fair competition in distribution of international taxation interest. And we also need to use the international tax cooperation mechanism against the tax base erosion and profit-shifting to eliminate the disputes and uncertainty of unilateral action.

(Editor: Zhang Chi)

Personal details:

Shi Zhengwen, Professor and Director, School of Civil, Commercial & Economic Law of China University of Political Science and Law, China; Vice-president, China Association for Fiscal and Tax Law.

Zhang Yawei, Ph.D Candidate, School of Civil, Commercial & Economic Law of China University of Political Science and Law, China.

[1] Though the non-resident enterprise does not control the resident enterprise directly, it, through the intermediate holding company, is an indirect intermediate control in nature. Especially, where the non-resident company controls the resident enterprise through more than one intermediate holding company, it will make the relationship between the investor and the resident enterprise more covert.

[2] See Zhang Wenxian, Jurisprudence(second edition), page 324, published by Higher Education Press,2003.

[3] See Zhou Qiguang, the Considerations, from the Tax Case of Vodafone, regarding the Deals of Income Tax of Non-resident Indirect Equity Transfer , Foreign Taxation, 2012, July.

[4] Yin Yinpin etc, the Research on Non-resident Enterprise Indirect Equity Transferring , Foreign Taxation, 2012, July.

[5] Li Songxi, International Practice on Taxing on the Non-resident Enterprise Indirectly Transfer the Equity of Resident Enterprise, International Taxation, 2013,Sep.

[6] Wu Zhenyu, the Analysis of Reasonable Commercial Purpose, International Taxation, 2013, Sep.

[7] See Victor Thuronyi, Comparative Tax Law,publishe by Kluwer Law International,2003, P.175.

[8] Fu Shulin, Considerations Regarding Taxation on Foreign Investor Indirectly Transferring Equity of Chinese Resident Enterprise, International Taxation, 2013,Sep.

[9] Liu Lei etc, Researches on Advance Ruling, Tax Research, series 9, 2012

动态报道

+更多- “新一轮财税体制改革与财税法05-10

- 中国政法大学财税法学术沙龙第04-07

- 法大财税法前沿讲座“企业涉税04-07

- 法大财税法前沿讲座“增值税热03-11

- 法大财税法学术沙龙第13期暨第04-24

- 法大举办“增值税与数字经济”06-26